Build Real Financial Confidence Through Smart Budgeting

Learn practical money management skills that actually work in your daily life. Our approach focuses on sustainable habits rather than quick fixes, helping you create a budget system that grows with your goals.

Explore Learning Programs

Why Our Budgeting Approach Works

Reality-Based Planning

We help you create budgets that actually fit your lifestyle. No unrealistic restrictions or complicated formulas – just practical strategies that work with your real income and expenses.

Flexible Systems

Life changes, and your budget should too. Learn how to adjust your financial plan when unexpected expenses arise or your income shifts, without abandoning your goals entirely.

Track Progress Easily

Simple methods to monitor your spending without obsessing over every penny. We teach you which numbers matter most and how to spot patterns that impact your financial health.

Your Budgeting Journey Over Time

First Month: Understanding Your Money Flow

Start by tracking where your money actually goes – not where you think it should go. Many people discover spending patterns they never noticed before. This awareness alone often leads to better decisions.

Three Months: Building Sustainable Habits

By now, budgeting becomes less of a chore and more of a routine. You'll start seeing which strategies work for your personality and which ones need adjustment. Small wins add up to noticeable changes.

Six Months: Confident Decision Making

You can make spending decisions quickly because you understand your priorities. Emergency expenses don't derail your entire plan anymore – you have systems in place to handle life's surprises.

One Year: Financial Independence Mindset

Your relationship with money has fundamentally changed. Budgeting feels natural, and you're making progress toward longer-term goals while still enjoying life today.

Common Questions About Budgeting

Meet Your Learning Guides

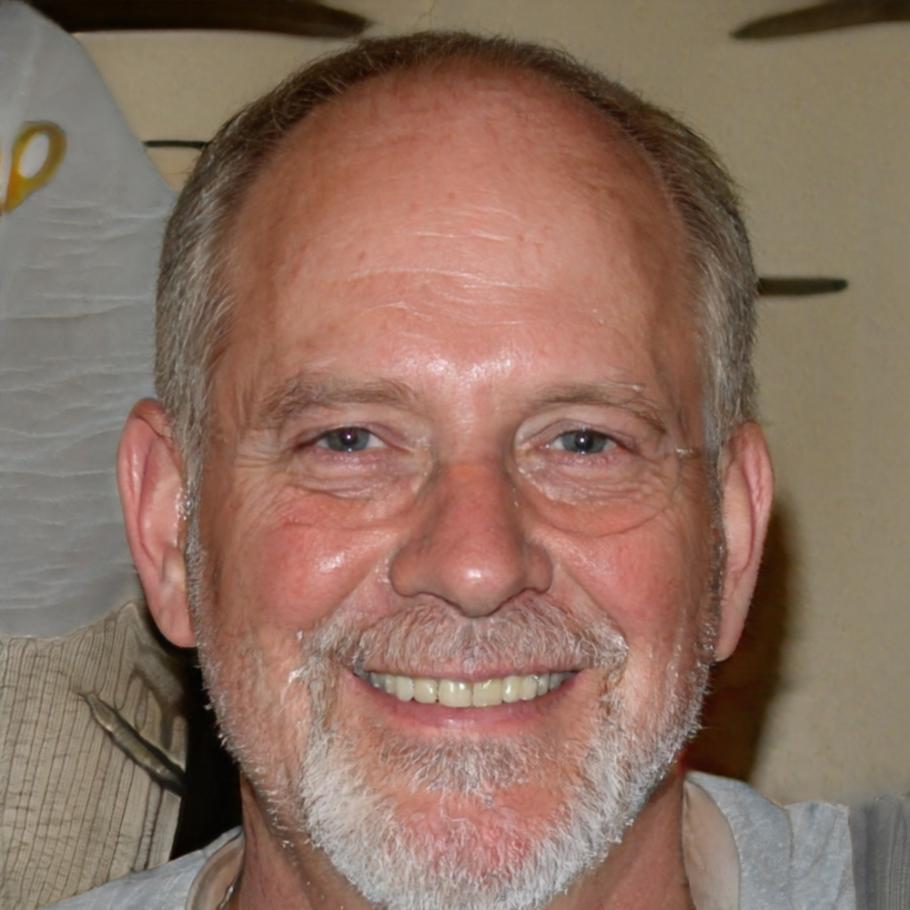

Kiernan Walsh

Personal Finance Educator

After helping hundreds of individuals organize their finances, Kiernan specializes in making budgeting approachable for people who find traditional financial advice overwhelming or unrealistic.

Brielle Novak

Behavioral Finance Specialist

Brielle focuses on the psychology behind spending decisions and helps people understand why they make certain financial choices, then develops personalized strategies that work with natural tendencies rather than against them.